View and download our BART Funding factsheet [pdf]

Remote work has changed how Bay Area residents live, work, and travel. It has hit BART and all other public transit systems hard, decimating transit ridership and, along with it, the transit fare revenue we rely on to keep trains running.

While millions of riders have returned to BART, they are riding less frequently, resulting in fewer trips. The Bay Area has the highest work-from-home rates in the nation and the slowest downtown recoveries and our ridership mirrors office occupancy. This has created an ongoing structural financial deficit of $350M to $400M, impacting BART’s long-term ability to deliver the high-quality transit service the Bay Area relies on.

In addition to receiving emergency funding during the pandemic, BART has acted to right-size service and its workforce, control labor costs, trim non-labor spending, and deliver major projects under budget. These measures have saved hundreds of millions of dollars while preserving essential service for the region.

BART’s funding deficit

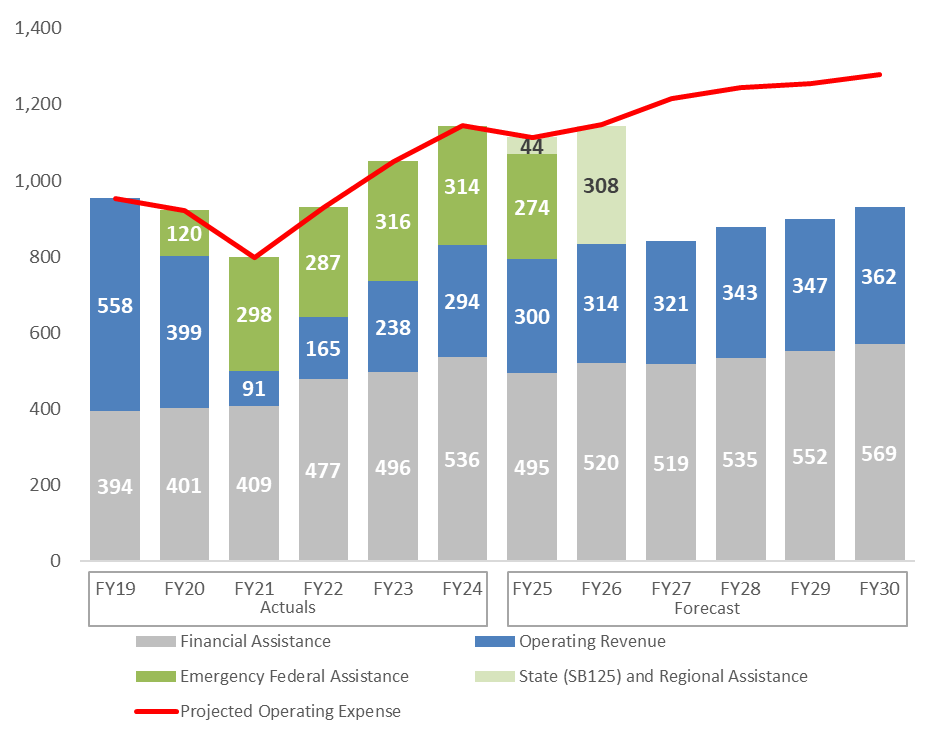

BART is now running service using emergency funds that will run out in 2026. BART balanced the FY26 budget with $35M in ongoing cuts and cost controls. The FY27 deficit is $376M. This chart below shows BART's funding sources ($M). It also shows how current revenues will not support current service levels.

BART is cutting costs*

Labor savings

- Eliminated 672 vacant positions (251 operating positions) in FY20 saving $32M

- A strategic hiring freeze on 56 positions (FY25 and FY26) with this count increasing each quarter, saving $7.8M annually and impacting all levels, including management

- Renegotiated with unions to reduce near-term retiree healthcare costs

- Executive management salary freeze in FY21

- Negotiated a 0% wage increase in FY22 instead of 2% saving $7-8M annually

- Indefinite deferral of planned staffing increases

Efficiencies

- Run shorter trains saving $27M in energy costs through FY26

- 5% reduction in non-labor budgets across all departments in FY26 saving $5M annually

- FY20 and FY21 service reductions saving $124M and currently reduced peak-period service

- Locked in low electricity costs though long-term contracts

- Saved $400M in new rail car acquisition with tight project controls, using in-house engineers, and speeding up delivery

- Parking garage LED lighting installation saving $1M annually in energy costs

- Reduced feeder bus payments saving $3M annually

- Eliminated transfer payment agreements with SFMTA and AC Transit saving $60M through FY26

Reduced office space footprint

- BART purchased its smaller headquarters building to eliminate the expensive long-term lease costs of the larger space, reducing headquarter footprint by 33% saving $13-15M annually or $71M through FY26

Increase revenue

- Installed new fare gates to reduce fare evasion, generating $10M in new revenue per year

- Inflation-based fare increases accounting for $35M per year and demand-based parking price increases

- Offer new fare products, such as Clipper BayPass, generating $7M per year

- Leasing of BART parking lots generating $6M through FY26

* List not inclusive of all savings

Pursuing new funding and use of loans

In 2025 the California Legislature enacted Senate Bill 63, supported by BART, authorizing a new transportation funding measure for placement on the November 2026 ballot. If the measure if successful, BART will receive an estimated $74M for BART operations in the last quarter of FY27, and an estimated $310M annually beginning in FY28.

Because the revenue from the ballot measure will not begin to flow right away, the state has offered a bridge loan, which must be paid back with interest. If a funding measure succeeds, BART will use $97M in loan funds to help balance our FY27 budget. However, the state loan does not help delay or prevent station closures because BART will not tap into the loan if the funding measure fails, because we would not be able to pay the loan back.

The state loan would make available to BART $285M, but we have not yet determined how much of it we may use. BART also has access to $395M from a federal Transportation Infrastructure Finance and Innovation Act (TIFIA) Loan with the U.S. Department of Transportation as a reimbursement for costs incurred in acquiring our Fleet of the Future rail cars.

Embracing independent oversight

BART is the only transit system in the Bay Area with an Office of the Inspector General to provide independent oversight of BART’s use of revenue. The OIG conducts performance audits and investigations of waste, fraud, and abuse. BART has accepted 92% of the OIG’s recommendations.

A 2025 audit by the Federal Transit Administration found BART is meeting standards in nearly two dozen categories, including financial management.

BART is subject to annual independent audits under the Single Audit Act. This examination of BART’s financial statements is detailed in Annual Comprehensive Financial Reports (ACFR) prepared by an independent organization in accordance with auditing standards generally accepted in the United States of America and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States.

BART is participating in the third-party Financial Efficiency Review required in SB 63, the law that enables the November ballot measure. This accountability measure requires agencies to implement cost-saving strategies and revenue generating opportunities. If the ballot measure passes, a second phase will involve adopting and implementing a data-driven action plan to improve financial sustainability.

BART’s previous two bond measures (Measure RR for system rebuilding in 2016 and Measure AA for earthquake safety improvements in 2004) both included independent oversight committees. In its 2025 Annual Report, the independent Measure RR Bond Oversight Committee wrote that based on its review of projects and data presented by BART staff, the committee believes BART is living up to the bond mandate and its promises to voters. BART is delivering rebuilding projects in a timely manner, those projects are enhancing the reliability and safety of the system, and the work is being pursued in accordance with industry best practices.

BART financial information is posted on bart.gov/financials

BART’s funding model before the pandemic

Before the pandemic, BART depended on fares to run service more than almost any other transit agency in the world with money from passenger fares and parking fees covering nearly 70% of the cost to run BART service. Now, because of remote work, only 30% of operating costs are covered by fares (as of FY25).

BART’s operating ratio*

FY26 forecast.............................................32%

FY25..........................................................30%

FY24..........................................................29%

FY23..........................................................26%

FY22..........................................................21%

FY21..........................................................12%

Pre-COVID.................................................71%

*Percentage of costs paid by passenger fares, parking revenue, advertising, and other sources

Cutting service still leaves a deficit

Rail has high fixed costs and low marginal costs. BART would have to cut service 65% to 85% to save 20% to 40%. Cutting service and scaling back on cleanliness and safety efforts could result in lower ridership, further reducing revenue. BART’s FY27 budget balancing plan is not sustainable for the long term. Without new funding, BART may not be able to sustain even reduced service for more than one or two years.

Planning for two financial scenarios

The BART Board of Directors will plan for both a “funding measure succeeds” and a “funding measure fails” scenario. If the measure succeeds, once funds become available, BART will be able to run normal service with efficiencies implemented.

At the annual BART Board Workshop on Thursday, February 12, BART staff presented Directors with detailed plans if a November 2026 ballot measure fails and no other operating revenue source is identified. You can read the full presentation here.

On February 26, 2026 the BART Board adopted an Alternative Service Plan outlining specific budget balancing details to solve a $376M deficit for the next fiscal year if no new funds become available to BART.

The plan includes specific cuts and financial strategies needed to balance both the FY27 (July 1, 2026-June 30, 2027) and FY28 (July 1, 2027-June 30, 2028) budgets. The plan includes service cuts, station closures, fare increases, a 40% reduction in system support services, laying off 1,200 employees, and a series of deferrals and one-time resources. The plan does not name specific stations to be closed and makes clear the BART Board will be responsible for all decisions on station closures. You can read the Alternative Service Plan resolution, resolution attachment, and presentation to the BART Board.

Alternative Service Plan Details

To take place in January 2027:

- 3-line service (Yellow, Blue, and Orange line service only, with limited peak service in only the peak commute direction on the Red and Green lines).

- 30-minute frequencies on every line.

- Closing at 9pm seven days a week.

- This service plan represents a 63% reduction in train hours.

- 30% fare and parking fee increases (the estimated average fare would increase from $4.98 to $6.38).

- Target approximately $30M in savings over 6 months from non-service budget reductions to fleet and non-fleet maintenance, police, cleaning, and administrative support functions.

- 600 employee layoffs.

- Continue deferrals of priority capital allocations and retiree medical contributions.

- Balance remainder of FY27 with one-time resources and financial deferrals.

Following the January 2027 cuts, staff will continuously assess ridership and revenue impacts and the performance of all District functions to determine if further reductions can be safely and legally implemented.

To take place in July 2027 if feasibly safe:

- Target over $175M in annual cost reductions through a cumulative 70% reduction in service hours:

- Maintain 3-line service, 30-minute frequencies on each line, closing at 9pm.

- Close up to 15 stations and/or up to 25% of system track miles.

- The BART Board will be responsible for all decisions on station or line segment closures.

- Increase fares and parking fees up to a cumulative 50%. The estimated average fare would increase to $7.26.

- Target annual operating expense savings of more than a cumulative $130M from non-service budget reductions to fleet and non-fleet maintenance, police, cleaning, and administrative support functions.

- Continue to defer retiree health contributions; defer most remaining capital allocations.

- Another 600 employee layoffs (total 1,200).

Contingency:

- If at any point it is determined BART can’t safely or legally operate with available resources, stop passenger service,

- Use existing District tax revenues to secure system assets.

- Work to determine system’s future.

Cost-efficient heavy rail system

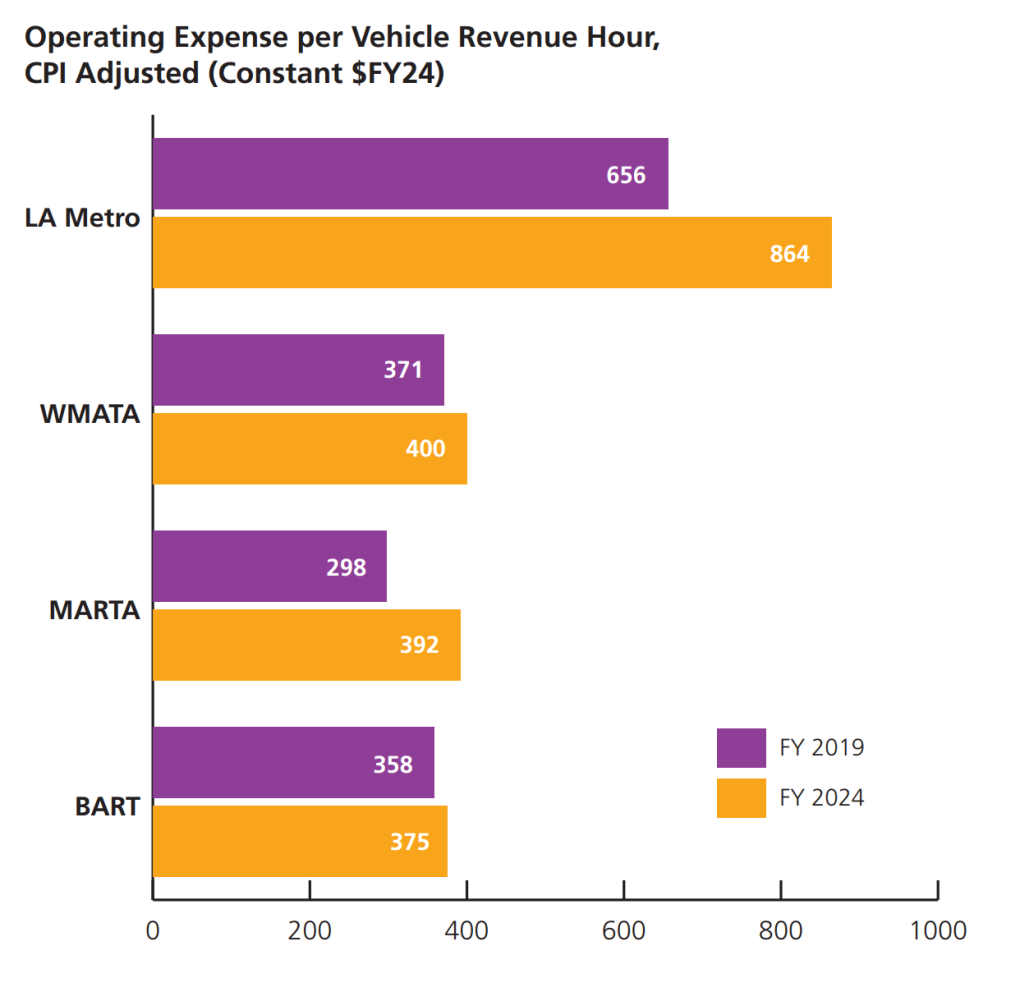

BART is one of the most cost-efficient heavy rail systems in the United States. With an operating cost of $375 per vehicle revenue hour (FY24), BART ranks 7th out of 16 U.S. heavy rail operators. BART’s costs are lower than its two closest structural peers: Washington D.C.’s Metrorail ($400 per hour) and Atlanta’s MARTA ($392 per hour). Both systems were built in the 1970s and share BART’s hybrid urban/commuter operating model. The few U.S. operators with significantly lower costs are primarily legacy systems built in the early 20th century (such as NYC and Chicago), which operate dense city subways rather than longer-haul regional rail.

Despite operating in a high-cost region, BART’s operating expenses have grown at a rate lower than inflation since 2019, even while opening the extension to Berryessa/North San José.

Ridership trends

BART's ridership matches Bay Area return-to-office occupancy rates. Work-related trips make up a smaller share of BART trips and riders are using the system more for personal needs. Evening, weekend, and airport service have retained ridership more strongly than commuting.

| Average Ridership | FY25 | FY24 | FY23 | FY22 | Pre-pandemic |

| Weekday | 171,981 | 162,374 | 149,574 | 111,311 | 408,723 |

| Saturday | 99,766 | 90,795 | 84,844 | 68,253 | 159,133 |

| Sunday | 74,566 | 68,080 | 62,573 | 48,373 | 111,972 |

Total Fiscal Year annual ridership

FY25 52.7M

FY24 49.6M

FY23 45.9M

FY22 34.5M

FY19 118M (before the pandemic)

Presentations given to the BART Board of Directors about the funding deficit

February 26, 2026: Board of Directors Meeting: FY27 Alternative Service Plan

February 12, 2026: Board of Directors Workshop

November 13, 2025: Board of Directors Meeting: FY27 Budget Strategy

May 6, 2025: Board of Directors Meeting: FY27 Operating Budget Scenarios

February 27, 2025: Board Workshop Meeting: Facing the Fiscal Cliff

October 24, 2024: Board of Directors Meeting: Update of Regional Transportation Revenue Measure

October 24, 2024: Board of Directors Meeting: Bay Area Transit Measure Survey Analysis

September 12, 2024: Board of Directors Meeting: Update on Regional Transportation Revenue Measure

June 13, 2024: Board of Directors Meeting: FY25 & FY26 Budget Adoption

May 7, 2024: Board of Directors Meeting: FY 25 & 26 Budget Sources, Uses and Rail Service Plan

October 26, 2023: Board Budget Workshop: Financial Context

October 26, 2023: Board Budget Workshop: Strategies to Reduce the Deficit

Feb. 23, 2023: Board Workshop: BART's Financial Outlook and Economic Context

Feb. 23, 2023: Board Workshop: Update on Advocacy Strategy

Jan. 26, 2023: Fiscal Action Plan and Advocacy Strategy

June 28, 2023: Statement from BART GM on state budget agreement

Advocacy Letters

May 28, 025 Letter to Governor Newsom regarding May Revision and Cap-and-Invest Plan

May 2023 Transit Operating Coalition letter to Ca. Legislative leaders

March 2023 Transit Operating Coalition letter to Ca. Legislative Budget Subcommittee Chairs

January 2023 Transit Operating Coalition letter to the Ca. Legislative Budget Committee Chairs

November 2022 Transit Agencies Joint Letter to the Pete Buttigieg about Transit Recovery Assistance